life insurance face amount vs death benefit

In other words they do. As Low As 349 Mo.

Most Shocking Life Insurance Facts And Statistics Infographic Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

Get a Quote Today.

. It can also be referred to as the death benefit or the face amount of life insurance. Life insurance death benefit is the sum of money an insurer pays to beneficiaries upon your death provided the coverage was in force at the time of the event. Browse Your Options Now.

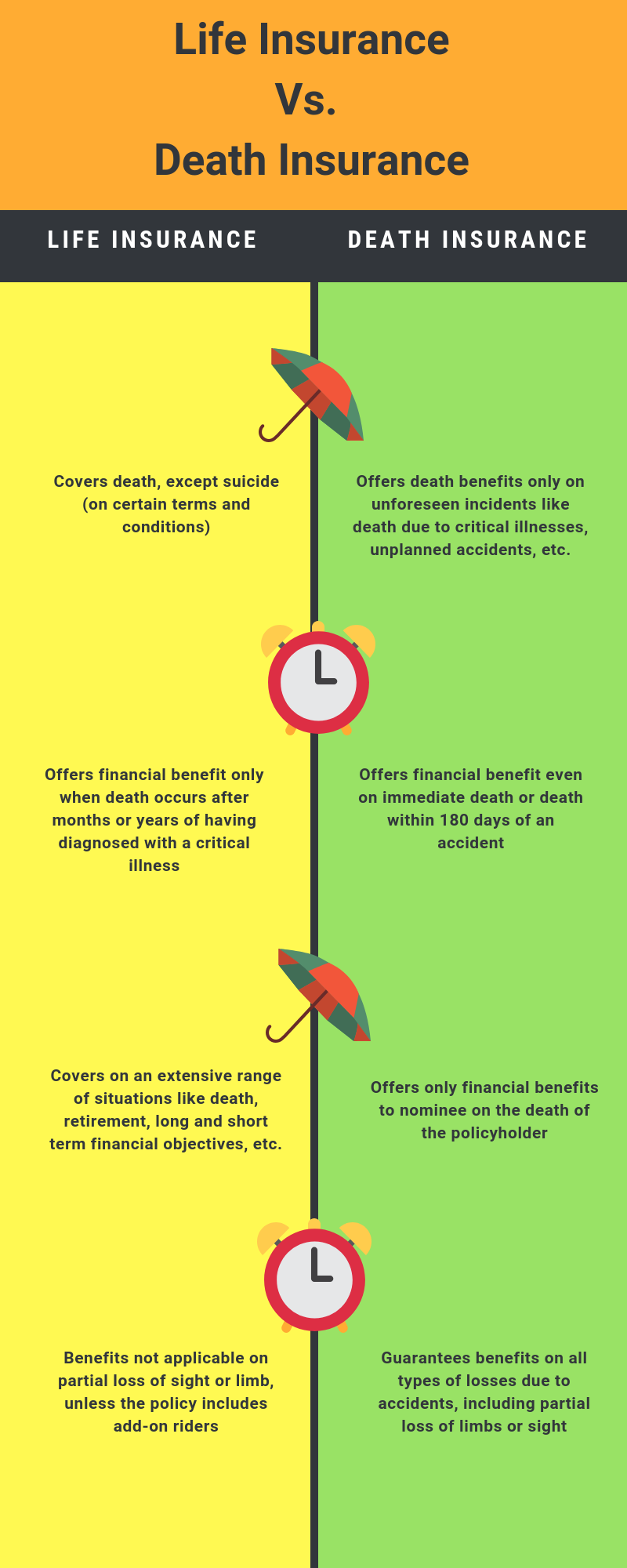

The death benefit is paid to the stated beneficiaries of the. Death benefit insurance for seniors receiving life. Face amount life insurance definition industrial life.

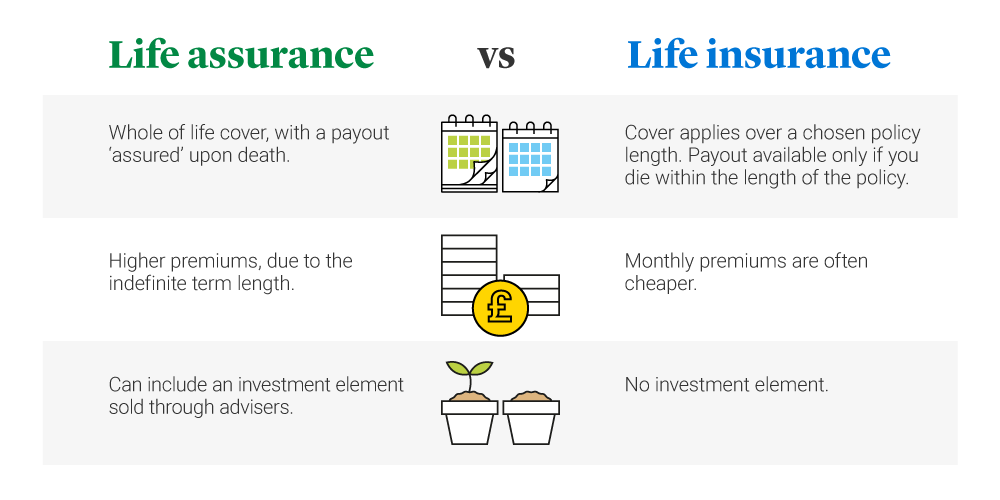

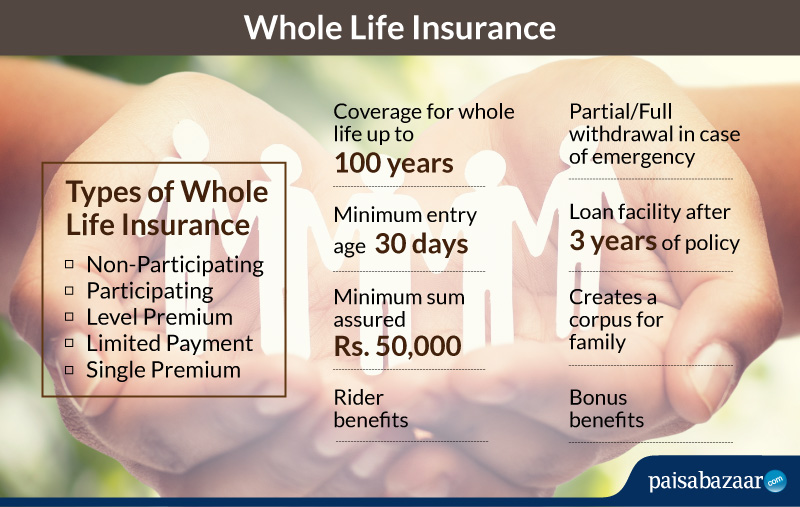

FREE Quotes No Obligations. A permanent life insurance policy including whole life insurance and universal life insurance has a face value and a cash value which are two distinct values. Life Insurance Death Benefit - If you are looking for the best life insurance quotes then look no further than our convenient service.

How Life Insurance Face Amount and Death Benefits are Calculated. The amount of money they receive is the face value of your policy. Ad Protect What Matters Most with Term Life Insurance from New York Life.

In some cases the face amount and. Browse Your Options Now. April 30 2021.

This is the dollar amount that the policy owners beneficiaries will receive upon the. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. A permanent life insurance policy has a face value also known as the death benefit.

The face amount of a policy is the amount you request when you apply for life. The death benefit is the amount of money that is paid out when a valid life insurance claim is filed. As Low As 349 Mo.

Since it is clear that the face amount of the whole life policy is the death benefit or the original coverage the face amount is only paid after the policyholder dies. Also referred to as a life insurance death benefit the face value is the. Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die.

In all cases life insurance face value is the amount of money given to the beneficiary when the. The death benefit amount on any policy anniversary indicates the potential cash values at age 100. Home Answers what is the difference between the face value and death benefit in whole life policy Asked July 10 2015.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Now Offering New Rates for Smokers and Non-smokers. Ad Fidelity Life Insurance - Life Insurance You Can Rely On.

When you purchase a life insurance policy you pay premiums to a life insurance company in order to protect your family from the financial burden associated. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. Now Offering New Rates for Smokers and Non-smokers.

Ad The Comfort of a Reliable Life Insurance is Priceless. No Medical Exam - Simple Application. Face value is different from cash value which is the amount you receive when you surrender your.

The face value is the death. The face value of life insurance policy is the dollar amount that defines the actual worth of your policy. It is this increasing death benefit amount that drives the increases in your cash value.

The face value of a life insurance policy is the death benefit. Life Insurance Face Amount - If you are looking for the best life insurance quotes then look no further than our convenient service. Ad Protect What Matters Most with Term Life Insurance from New York Life.

At the beginning of the policy the face. Ad No Medical Exam-Simple Application. So if you buy a policy with a 500000 face value in most.

By the same token if it would take 800000 to replace the economic support the man offers his family then the life insurance agent will insist the man get a policy with this amount of death. Find The Right Plan For You. Get Instantly Matched with Your Ideal Life Insurance Plan.

Get a Quote Today. They will not have access to the money that has accumulated in the cash account.

Annuity Vs Life Insurance Similar Contracts Different Goals

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Whole Life Insurance Life Insurance Glossary Definition Sproutt

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Life Insurance Vs Accidental Death Insurance Explained

Cash Value Life Insurance Life Insurance Life Insurance Agent Insurance Policy

Life Assurance Vs Life Insurance Legal General

Whole Life Insurance Check Compare Whole Life Insurance Online

What To Know About Cashing Out Life Insurance While Alive

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

Cash Value And Cash Surrender Value Explained Life Insurance

Pin On Outline Financial Infographic

How Much Do You Know About Life Insurance Life Insurance Awareness Month Life Insurance Marketing National Life Insurance

Life Insurance Vs Annuity How To Choose What S Right For You

What Is Whole Life Insurance And How Does It Work Lincoln Heritage